Consequently, this translates into greater overall interest savings.Īccelerated bi-weekly payments are most evident when applied to extended loans with large balances. The larger payment literally accelerates debt reduction and shaves years off your loan term.

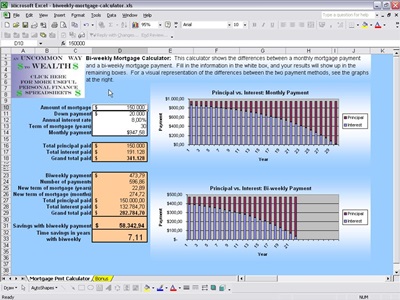

When you make 26 payments, this results in 13 whole payments annually. The equation is as follows:Įssentially, we divide the monthly payment in half to calculate the accelerated bi-weekly payment. On the other hand, an accelerated bi-weekly payment is derived by using the standard amortization formula and dividing its quotient by 2. 30-year term multiplied by 12 is 360 a 30-year term multiplied by 26 payments is 780) for bi-weekly, the APR is divided by 26 for monthly interest, it's 12) The standard amortization formula is also used to compute payments made daily, weekly, semi-monthly, monthly, quarterly, semi-annually, and annually. The resulting payment amount is also slightly lower compared to its accelerated counterpart. Though you may encounter them being mentioned interchangeably, these two concepts are not the same.īi-weekly payments are calculated using the standard amortization formula. Accelerated Bi-weekly Loan Paymentsīi-weekly loan payments differ from accelerated bi-weekly loan payments. It's best to clarify with your lender before making the switch. Meanwhile, other lenders do not offer bi-weekly payment options at all. Planning to shift to a bi-weekly payment schedule? Some lenders impose additional fees when you change your billing schedule. Just make sure your lender is receiving them on time. The good news is banks can automate bi-weekly payments. If you do not receive your salary on a bi-weekly basis (others are paid semi-monthly or monthly), you can still use a bi-weekly payment schedule. The drawbacks? While some people are more comfortable with a bi-weekly payment plan, others find it too taxing to pay every other week. If you think this is a good way to make sure you cover your loan payments, then consider this strategy. The amount is actually a little less than half of your regular monthly payment. Bi-weekly payments will also not feel as heavy on your pocket, even though you are essentially making 13 payments a year. Second, since you're getting the amount straight from your paycheck, it eliminates the possibility of spending that money on other things. If you tend to forget payments once a month, this billing schedule obliges you to keep track of your payments every other week. Once you receive your salary, you can immediately set it aside to pay your loan. One, it's easy to manage loan payments when your billing schedule corresponds with your bi-weekly pay period. While it does not reduce your loan balance or payment duration very much, there are people who prefer this setup. It can also remove around less than a month from your loan term. The table above shows you can save $$69.98 in interest when you make bi-weekly payments.

BIWEEKLY LOAN CALC REGISTRATION

These calculations exclude things like loan application fees, vehicle registration costs, and sales tax. *All loan calculations on this page are for the principal and interest portion of the loan. The table below compares interest and time savings on monthly loan payments versus bi-weekly payments. To give you a better idea, let's suppose you have a 5-year car loan. It helps save a bit of interest cost and may remove a few months on your loan term. How does it affect your loan status? Following a bi-weekly payment schedule allows you to pay a bit more money on your loan. In contrast, a regular monthly payment only generates 12 payments a year. When you add up your payments, you actually make 13 loan payments annually. It takes advantage of a 52-week schedule which is equivalent to 26 payments. How Do Bi-Weekly Loan Payments Work?īi-weekly loan payments are paid every two weeks (that's every other week) to your lender. We'll also compare them with monthly payments and accelerated bi-weekly payments to help you assess which option works better for you.

BIWEEKLY LOAN CALC HOW TO

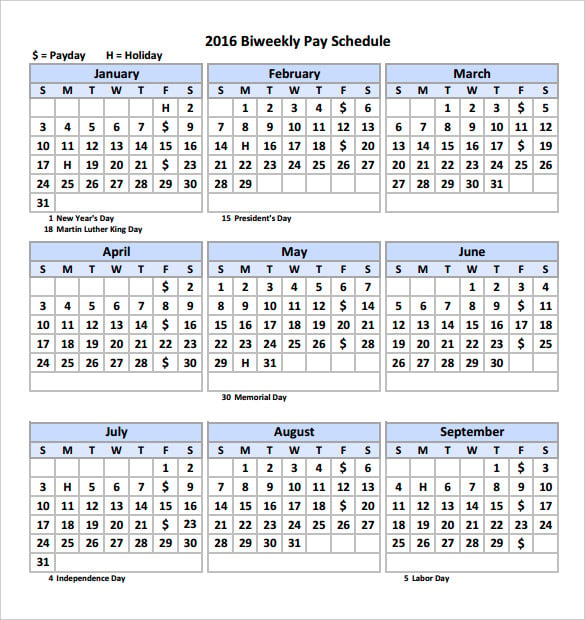

In this guide, we'll discuss how bi-weekly loan payments work, as well as how to calculate it yourself. It allows them to synchronize their bi-weekly payment dates with their salary's pay period. For other people, paying every two weeks is actually more manageable. It allows you to send the same amount at a fixed date, making it easy to track your loan payments.īut apart from the standard monthly payments, did you know you can change your payment schedule? Specifically, you can choose a bi-weekly loan payment plan.

And for the most part, paying once a month is convenient. When you take out a loan, lenders usually require a 12-month billing schedule. Guide published by Jose Abuyuan on February 14, 2020 Understanding How Bi-weekly Loan Payments Work

0 kommentar(er)

0 kommentar(er)